Retirement: How much is enough?

“It’s all about early planning and sticking to the plan until something change. ”

Retirement calculator:

How much do I need to save to retire “well”?

It depends. How much money do you need after retirement? What is your time horizon? How much % return can you earn with your portfolio strategy?

You can find online “Future value calculator”, which you can play with by varying the different factors.

Not bad calculator: https://www.calculator.net/finance-calculator.html

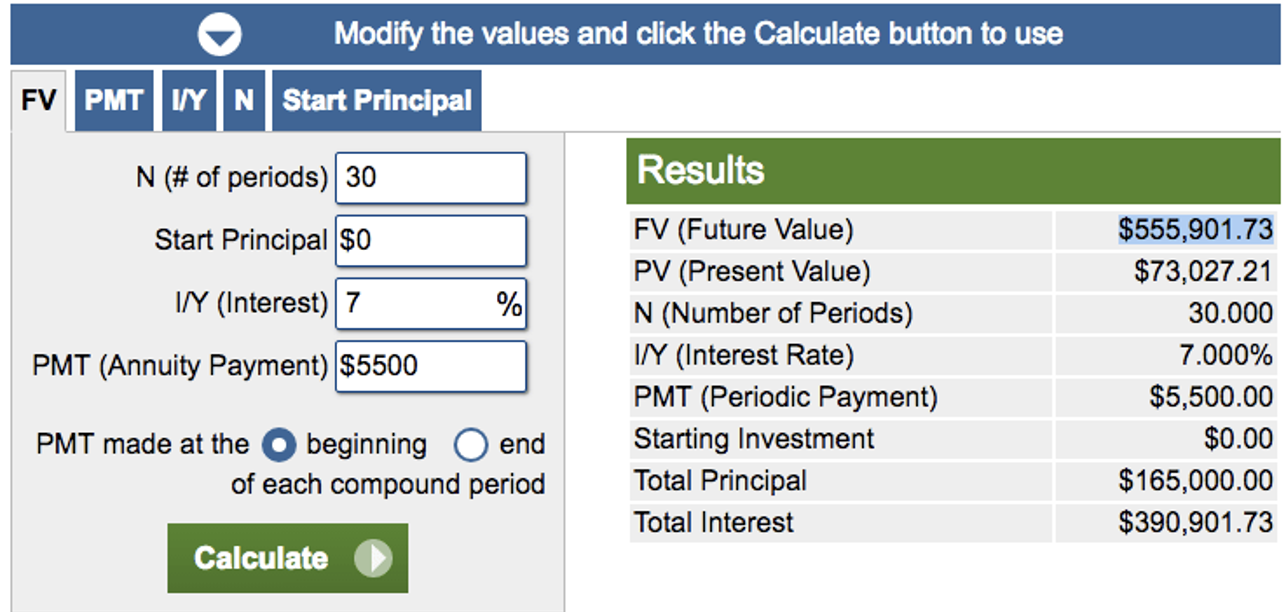

Example 1: Find how much money will I get from savings and investment.

We will use the TFSA account (tax-free) and if law doesn’t change, you should be able to contribute $5,500 per year.

Assumptions:

Typical serious person = 30 years old.

Retirement age = 60 years old

Time horizon = 60-30 years = 30 years

Start money = $0 (Not saving money yet)

Interest = 7% (Assuming we invest in an Index ETF, low fees, just playing the market)

Payment = $5,500 (Maximum contribution per year, $260 per pay check)

We look for the “Future value”. How much will it give us after 30 years of savings and compound interest?

Answer = $555,901.73 (Pretty nice amount for retirement or maybe not.)

retirement calculator

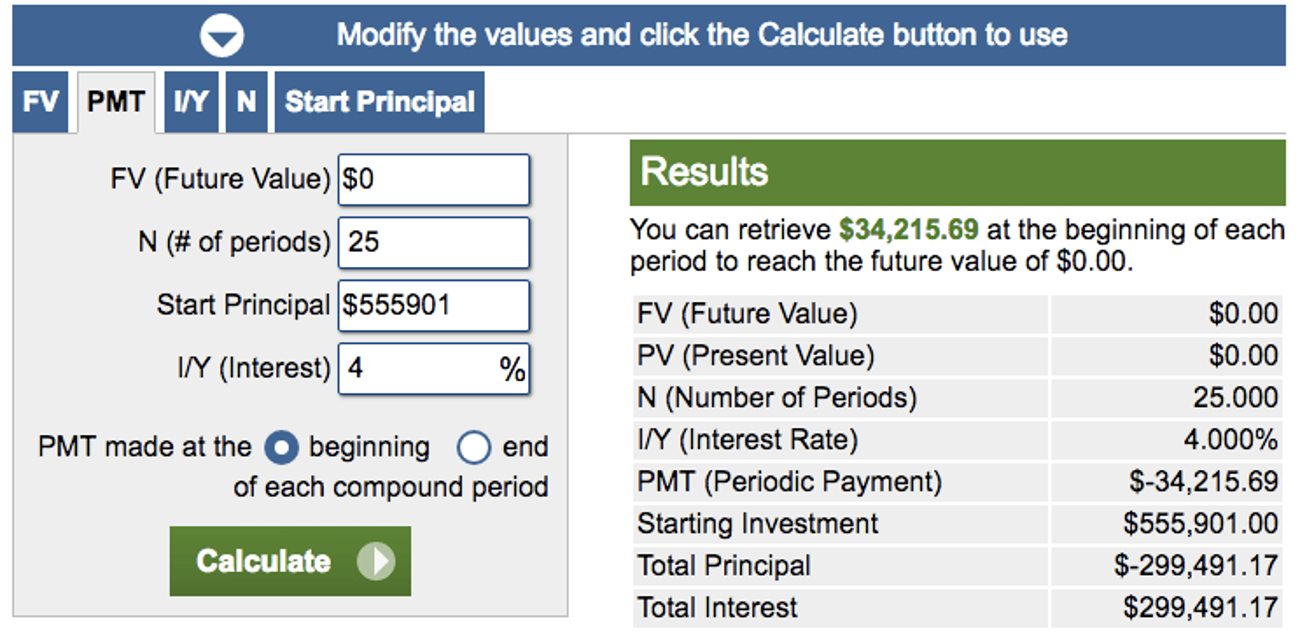

Example 2: Is the amount above enough to cover my spending?

Let’s use the TFSA account again (Tax free). Now we are “60 years old.” Let’s say we decided to die at 85 years old. How much money can I withdraw every year until I “die”?

Assumptions:

Future value = $0 (We won’t leave money for anyone, let’s spend everything until we die.)

Time horizon = 85 – 60 years old = 25 years

Start principal = $555,901 (Look example 1, how much money we have after the 30 years of savings)

Interest = 4% (Because we want to withdraw money, we reduce risk in our portfolio.)

We look for “Payment”. How much can I withdraw each year until I die?

Answer = $-34,215.69 (It’s not bad, modest lifestyle.)

Example 2: retirement withdraw cash

Other example?

Basically, you can play around to make different scenarios.

How many years to save $1,000,000?

How much to save per year to get $1,000,000?

What portfolio rate of return do I need to achieve my goal?

How early can I retire?

Saving $5,500 per year and investing in an index ETF at 7% return will give you $1,000,000 in 37 years.

Notes: Every person situation is different. The calculator is not perfect, but it puts numbers into perspective.

example 3: How many years to $1mm?

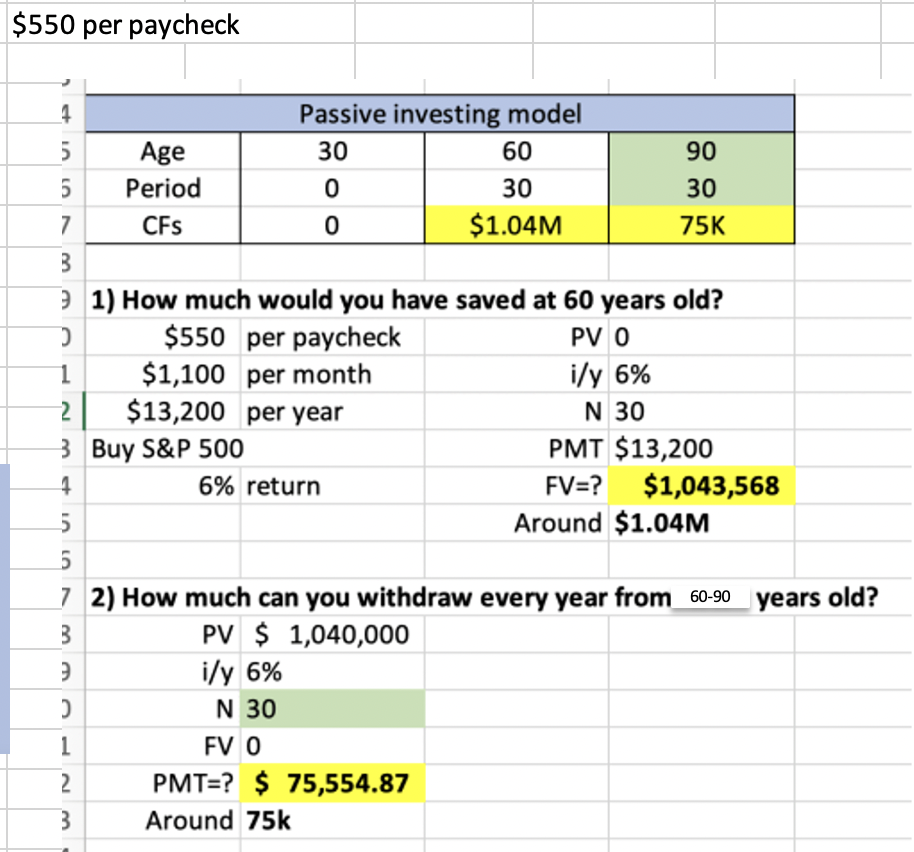

More realistic situation: Save $550 per pay check, Have $1mm at 60 y/o, withdraw $75k from 60 to 90y/o

How much is enough?

Making money is nice. Saving money is nice too. Investing it, sure.

But, How much is enough?

I think the first step is to cover your “operating expenses”, then anything above is “EXTRA”. After doing calculation from the frugal lifestyle, a single person living in Canada can have a very frugal nice okay life with $12,500 per year, which is around 1,050$ per months or 250$ per weeks. It’s enough for Rent, Grocery, transportation, etc.

The idea here is to see things from a bigger perspective.

Whenever I talk with someone, they always tell me they need to “make more money”, but never did they tell me the specific amount.

My goal is $500,000 for retirement. With $500k invested in dividend stock portfolio at 5% yield, you get a nice $25k a year sitting on money, which is $2k a month or $480 per week. This is more than enough to cover your frugal expenses and treat yourself once in a while. We didn’t even talk about the “growth” of your portfolio, just focusing on dividend. (See tables)

Dividend portfolio table

The hardest part is to start. With a $5,000 dividend stock portfolio, you only get $250 per year or $20 a month. People will laugh at you. Nevertheless, you are making this $20 a month more than anyone else. Those little small win will build up into a giant snow ball.

SimpleLifeBalancing.