Frugal life.

When you have income coming, we have a tendency to spend more money than we need. What if we find ways to save up this extra money for investments.

“Make money work for you. Don’t be a slave of money.”

Things that I can do to save money while enjoying a decent quality life.

Value for you: Highest utility for lowest amount spent.

1) First, we will set up a goal to keep us motivated.

Goal: Save money in investment account for _____.

SMART goal: Save $10,000 in the investment account by the end of the year.

2) Second, we will identify weaknesses in our finance management and strength.

BAD: High spending habits

Food and restaurant

Clothes

Activities / going out

Bad tendency to pay for others or help other people pay

Online purchase for new experience

GOOD: High saving habits

Budget for quarterly period

Apps to keep track of all expenses

Prepare your own meals

Acknowledge problem with financing

Leave item in online shopping cart in a while before buying

3) 80/20 rules:

Find the top 5 highest spending and focus on those.

· e.g.: Rent, Phone, Internet, Restaurant/ alcohol, online subscription, clothes/ toys, transportation

“Just focus on a few keys things, balance your life. It’s better to be slow but confident than very fast but fragile.”

4) Define concrete action or self-rules to follow in order to achieve our goal.

Creating these new finance habit will push us toward a new living style and this will open door to new opportunities as we experience the change.

New Finance habit:

Cut online subscription you don’t use.

Quarterly: Call cellphone and internet provider for better deals.

Continue tracking spending with the apps + Excel sheet

Choose cheaper options if eat outside:

· Examples: Iced coffee small size instead of large ice cap

· Skip appetizer, dessert, buy cheapest carb meal/ or just go for a drink instead of a meal

· Eat outside only with friends or 1 cheat meal per week

· Try new food during the cheat meal period

· Stick with basic food: cook with rice, cheaper meat cut, vegetable

· Decline offer to eat out

· Don’t actively create eating out opportunities

· Invite friends to eat at your place (share grocery cost)

Don’t buy clothes anymore. You have more than enough.

Don’t put yourself in a situation where you might be push to spend money.

Don’t pay for people anymore. Don’t help people by lending money. If you do, keep track and state conditions. Get the money back within 31 days.

Don’t make any necessary online purchase.

Gold rule: Buy what you need; not what you want.

Force yourself in free activities

Instead of saving time by spending more; use time to save money.

· e.g.: Bus vs plane ticket

“Life is about recreating yourself.”

5) What action can I take to save money?

(1) Cook my own healthy meals: Less than $5 per meal

(2) Rent: Choose the cheapest alternative that fit your lifestyle

Live in a studios / with parents/ with roommates

(3) Cellphone: look better provider online

Public mobile $25/months

(4) Home internet: Call to bargain

ALTIMA TELECOM, Unlimited 10mbps

After TAX price: $32.17CAD

(5) Transportation:

Bike sharing $1-2 per ride

Public transportation $3.50 per ride

Rules #1: Don’t buy a car.

waste money on car insurance, gas, maintenance.

depreciating asset.

(6) Gym: Econofitness ($14.92/ months after tax)

(7) Hair cut: $25 per 2 months (wash + cut)

(8) What about the other expenses?

Before buying anything. Ask yourself….

· Will it add value to my life or make me more money?

· How much can I sell it on the 2nd hand market if I don’t use it anymore?

Look for the items on 2nd hand market or online:

· Facebook market, Kijiji, thrift store

· Aliexpress, Ebay, Amazon, Walmart

· Retail store mark-up price too high.

Look for special promotions

· use “FLIPP app”, black friday, boxing day, student discount, etc.

(9) What do I do with all the money I saved?

INVESTMENTS! Make money with money.

(10) BONUS: Don’t own it. Find a friend who owns it.

Don’t buy a dog/ cat. Play with your friend’s one.

Don’t subscribe to NETFLIX, find someone who already pays for it.

Don’t buy a boat. Ride it with your friend who owns it.

Don’t buy a big house. Visit your friend’s big house.

Etc.

____________________________________________________________________

Good resources: https://www.mrmoneymustache.com/

The Pursuit Of Status How To Avoid Chasing The Wrong Things : video link

Comment: One small spending can lead to many “complementary” or related goods because of our need for creativity. Also, the idea of spending to show our status (animal instinct to build status => first to get meat and mate choice)

· Example: Buy a bottle of wine. Then, buy wine opener, buy wine glass, wine decanter, cheese, cheese knife set, wine book, etc.

Another chain example: Buy a business white shirt, buy pants, Blazer, tie, socks to match it, new watch, upgrade shirt with cufflinks, need to upgrade to a better blazer, better tie, get a car, etc.

Pro tips:

Flipp: App/ website which puts all flyers together, so it saves times.

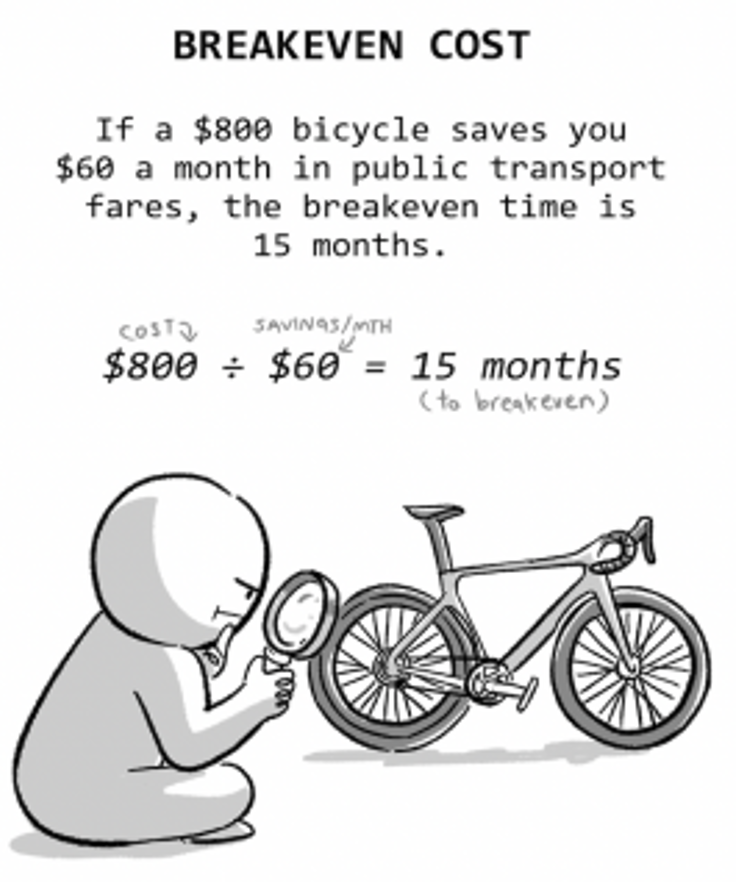

Update #1: Break-even Cost

I like this concept. Buy something that over time will save you money.

I bought a Brita Water filter for $20. It saves me from buying $0.25 bottled water. Also, I bought protein powder. The ratio protein g/$ is better than eating more chicken breast.

source: Wokesalaryman

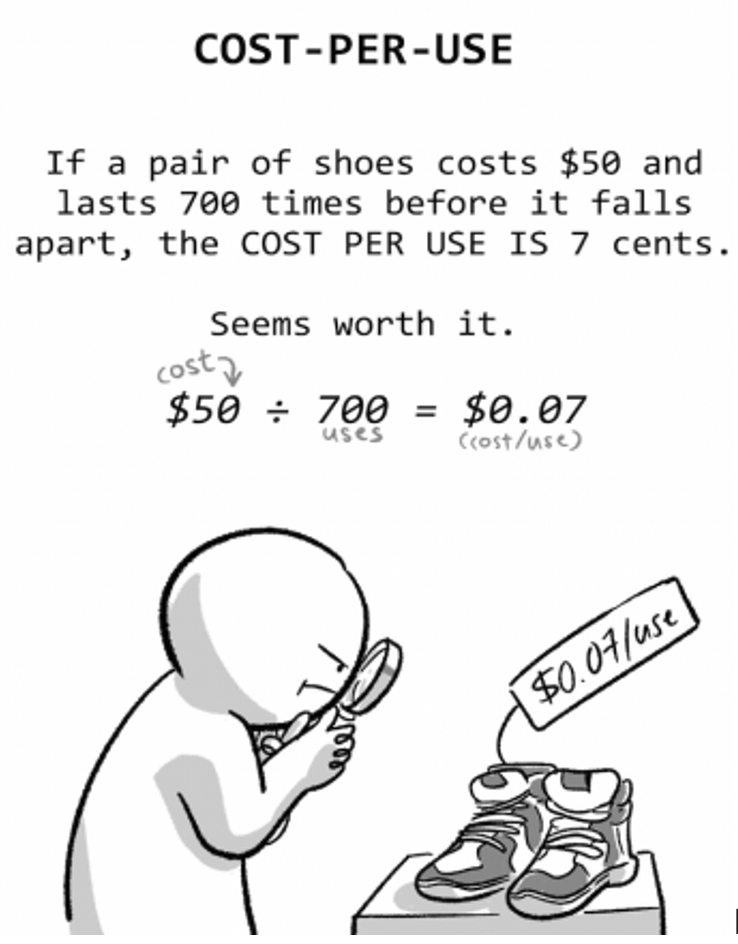

Cost-per-use: I use this to justify some purchase too.

Winter jacket $120. Use it for 4 months everyday = $1 per use.

Source: Wokesalaryman

Comments:

It’s good to save money by being frugal, but there is a point of diminishing return where it makes more sense to spend money.

e.g.: Take bus instead of uber (Trade off: Pay $10 more to save 30mins after work free time)

e.g.: $5 pizza slice vs chicken rice veggies meal $10 (Pay 2x the price, but healthier meal option)

The idea to be frugal and minimalist is to be able to spend money on things important for you.

e.g.: Save money from renting with roommate -> use savings to travel

e.g.: Save money from not buying new clothes -> use money on keyboard hobbies

“Die with zero” -> Need to strike a balance between saving money and spending it.

e.g.: Save being frugal and suffer, suddenly die from sickness -> should’ve spend money on healthier food and gym membership

e.g.: Work really hard and overtime, retire late, die without spending all that money

SimpleLifeBalancing.