Trio Combo Portfolio.

I was trading a lot recently and improved my trading skills. I feel swing trade is good to capture a quick upside move while managing risk, but because we just hold the stock for a “swing” and get out at target price/ stop loss, we miss on some “close-your-eyes buy-and-hold” strategy. Also, you miss on the dividends. What about the passive investing ?

“A lot of ideas is good, but a lack of structure won’t bring you anywhere.”

I think it’s best to have 3 accounts: passive investing account, dividend value investing account and the trading account.

(1) Passive investing account: “Insurance barrier”

The idea of this portfolio is to give you a “cushion”. If all fails, you still have something to cover your expenses during your retirement.

Strategy:

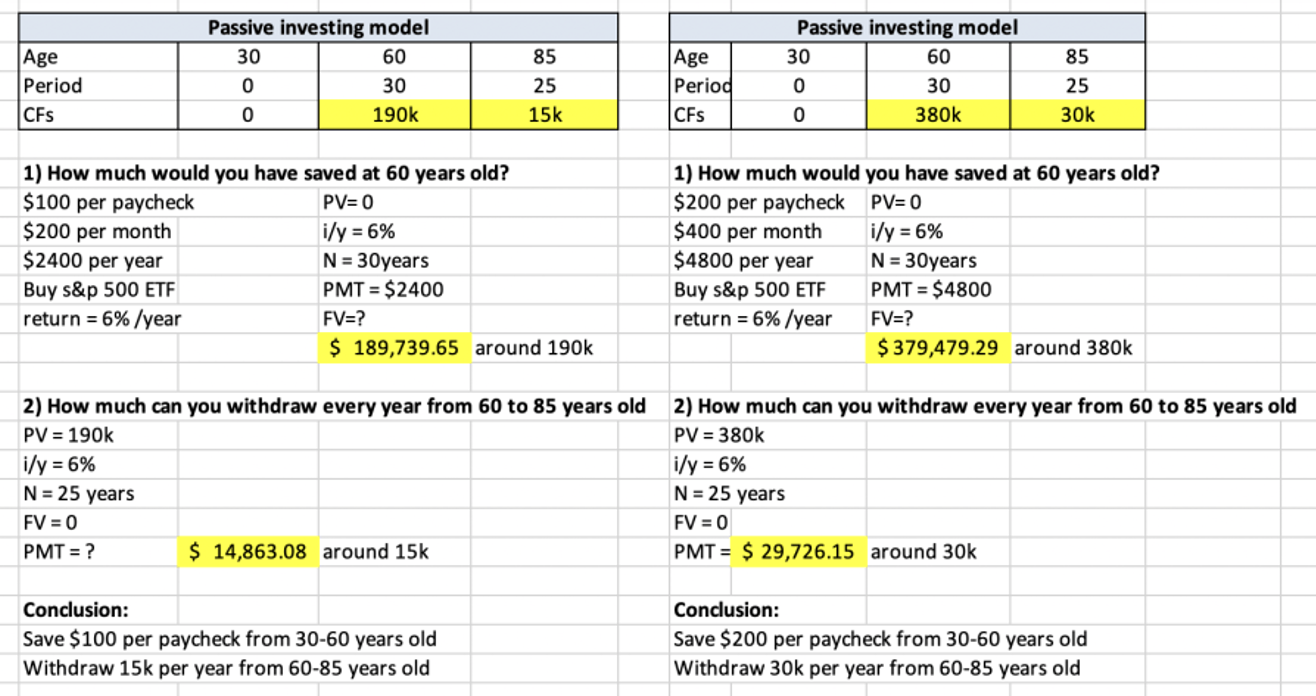

Save $100-$550 per pay check (bi-weekly) or $2,500 – $13,200 per year.

Buy S&P 500 ETF. (ideally bi-weekly, if not yearly)

Good practice: No/ low trading fee brokerage, tax shelter account.

Withdraw 15-30k per year for expense, etc.

Save $100 vs $550 for 30 years

Use annuity calculator to figure out how much the investment grow after 30 years and how much you can withdraw every year until you die.

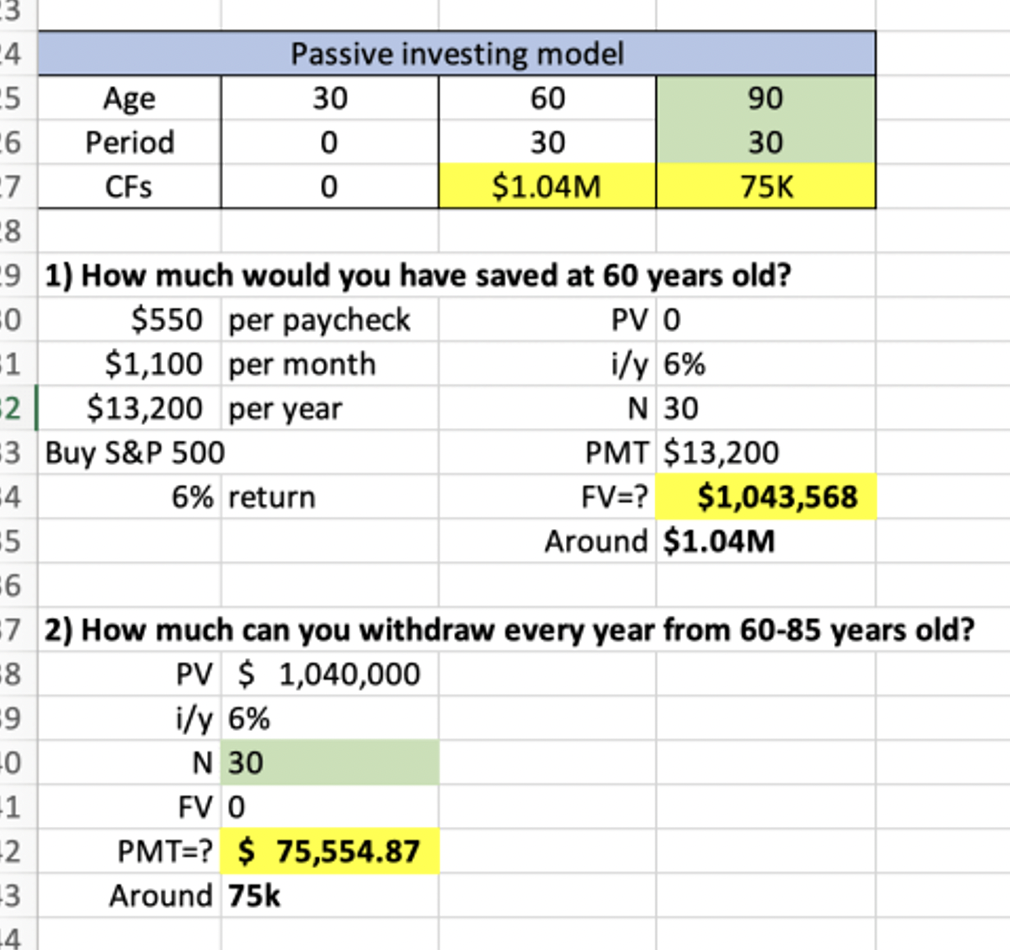

Example: How much do I need to invest bi-weekly from 30 to 60 y/o to be able to withdraw 75k/ years from 60-90 y/o?

Getting started approach:

Saving $100-200 per paycheck for 30 years -> Withdraw $15-30k for 15 years during retirement

More robust realistic approach:

Saving $550 per paycheck for 30 years, withdraw $75k/ year during retirement for 30 years.

Staying the course:

We don’t know the return for S&P500. Some years, it will go up more. Other years, it can go down. Nevertheless, we want to know how much minimum we need to have each year in the account to keep the compounding going.

Easy solution: Create an annuity schedule.

e.g.: Year 2 = $27.2k , market didn’t move that year, so you can add $800 to bring the balance to $27.2k

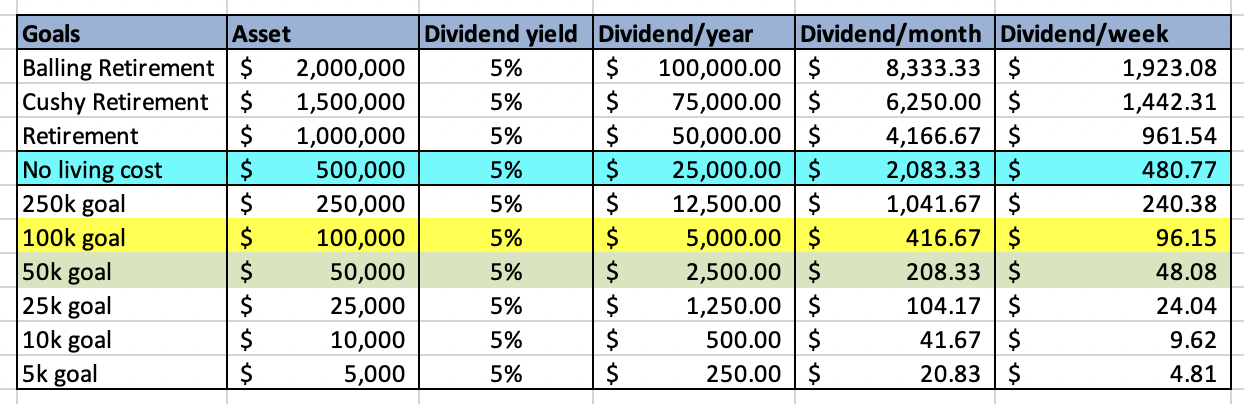

(2) Dividend value investing account: “Fortress”

The idea of this portfolio is to capture the benefit of “buy-and-hold” strategy. You buy strong high dividend paying stock when they are cheap and just hold to get dividends.

Strategy:

This should be the bulk of your investment account.

Buy strong high dividend stock (e.g.: banks, telecom, utilities)

Never sell.

Reinvest dividends by buying more stock

With $1mm at 5% dividend yield -> you get $50k per year. Pretty good for retirement. No need to work.

(3) Trading account: “Ninja explorer”

The idea of this portfolio is to swing trade.

Strategy: Really up to you from this point.

Define your trading plan, execute it.

Focus on growth, growth stock, option strategy, margin account, short-sell.

Choose a fix amount to “play” with.

· e.g.: 5k to 10k account.

Any additional profit should go to the “Passive investing” or “Dividend value account”.

Example of trading strategies:

Limit gain No loss Strategy:

Buy:

Buy stock you want to hold forever

Trade size $5000 to $10000 USD or CAD

Max gain 1% = $40 to $90

Profit = $50 - ($5*2) = $40

Sell:

Sell limit order, stock is up 1%

No loss: If stock goes down, just hold.

Opposite of buy and hold:

Buy and hold: Profit on A to B

LGNL strategy: Profit from volatility between A and B

Conclusion:

The idea of the trio combo account is to build a solid, exciting and less stressful investing structure.

When you build your “fortress”, you get recurring cash flow of dividends from solid companies. The risk of them going bankrupt is low. If they were to go down, you already built an “insurance barrier” with S&P500 passive investing, which will provide you the “minimum” cash you need to cover your future retirement expense. Anything else is extra.

When you have extra cash, you can choose to build onto the “fortress” or send some “NINJA explorer” to get yourself some additional gold. If the Ninja dies, you still have the fortress and insurance barrier to rely on, so it makes your swing trade mentally less stressful, therefore allows you to make more rational decision.

If the “Ninja” comes back with additional gold. You can just reinvest it into the fortress or strengthen the “insurance barrier”.

In an ideal scenario, your fortress’ dividends should be large enough to cover your retirement expenses.

Case:

Insurance barrier: $380k => $30k per year

Fortress: $500k => 5% dividends => $25k per year

Total: $55k /year

SimpleLifeBalancing.